COMMISSION IMPLEMENTING REGULATION (EU) 2023/1057of 26 May 2023 concerning the classification of certain goods in the Combined Nomenclature- "Official Journal of the European Union", No L 142/11 оf 1.6.2023 - |

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to Regulation (EU) No 952/2013 of the European Parliament and of the Council of 9 October 2013 laying down the Union Customs Code(1), and in particular Article 57(4) and Article 58(2) thereof,

____________

(1) OJ L 269, 10.10.2013, p. 1.

Whereas:

(1) In order to ensure uniform application of the Combined Nomenclature annexed to Council Regulation (EEC) No 2658/87(2), it is necessary to adopt measures concerning the classification of the goods referred to in the Annex to this Regulation.

____________

(2) Council Regulation (EEC) No 2658/87 of23 July 1987 on the tariff and statistical nomenclature and on the Common Customs Tariff (OJ L 256, 7.9.1987, p. 1).

(2) Regulation (EEC) No 2658/87 has laid down the general rules for the interpretation of the Combined Nomenclature. Those rules apply also to any other nomenclature which is wholly or partly based on it or which adds any additional subdivision to it and which is established by specific provisions of the Union, with a view to the application of tariff and other measures relating to trade in goods.

(3) Pursuant to those general rules, the goods described in column (1) of the table set out in the Annex should be classified under the CN code indicated in column (2), by virtue of the reasons set out in column (3) of that table.

(4) It is appropriate to provide that binding tariff information issued in respect of the goods concerned by this Regulation which does not conform to this Regulation may, for a certain period, continue to be invoked by the holder in accordance with Article 34(9) of Regulation (EU) No 952/2013. That period should be set at three months.

(5) The measures provided for in this Regulation are in accordance with the opinion of the Customs Code Committee,

HAS ADOPTED THIS REGULATION:

Article 1

The goods described in column (1) of the table set out in the Annex shall be classified within the Combined Nomenclature under the CN code indicated in column (2) of that table.

Article 2

Binding tariff information which does not conform to this Regulation may continue to be invoked in accordance with Article 34(9) of Regulation (EU) No 952/2013 for a period of three months from the date of entry into force of this Regulation.

Article 3

This Regulation shall enter into force on the twentieth day following that of its publication in the Official Journal of the European Union.

This Regulation shall be binding in its entirety and directly applicable in all Member States.

Done at Brussels, 26 May 2023.

For the Commission,

On behalf of the President,

Gerassimos THOMAS

Director-General

Directorate-General for Taxation and Customs Union

ANNEX

Description of the goods |

Classification (CN code) |

Reasons |

(1) |

(2) |

(3) |

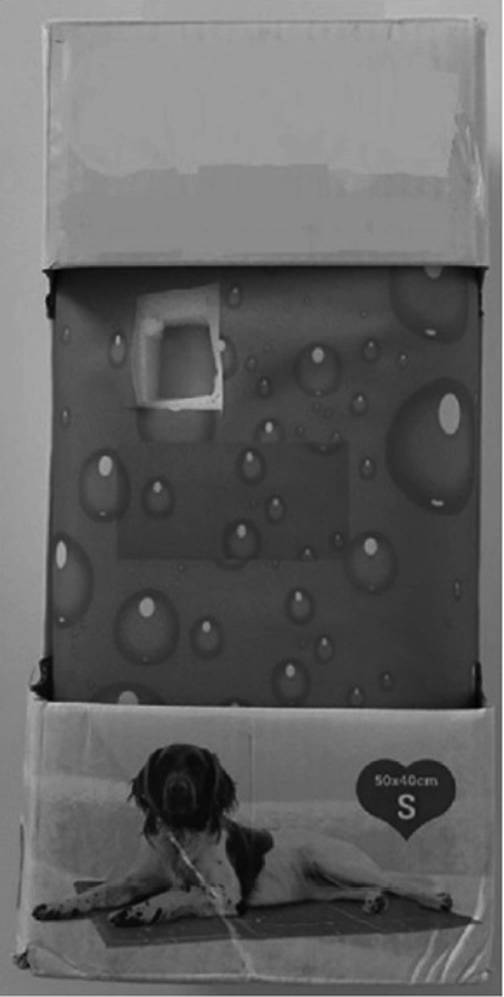

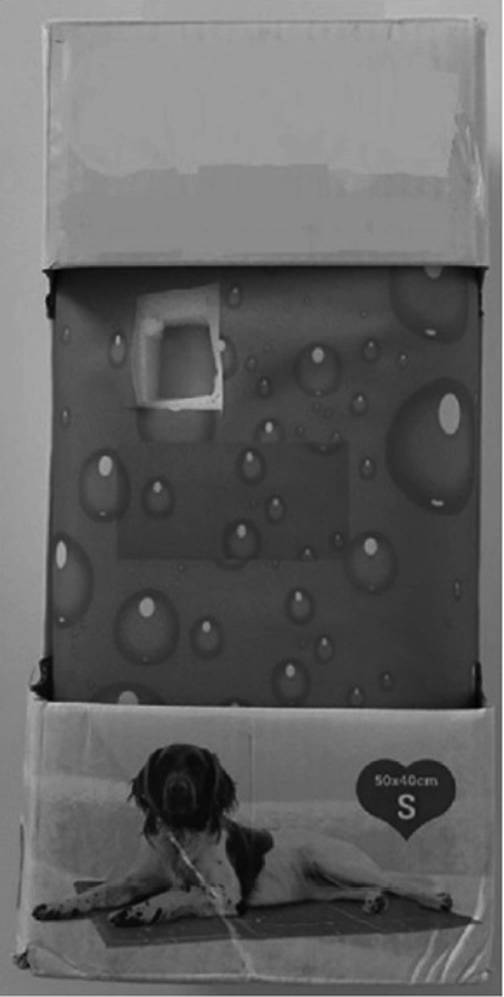

Rectangular article ('cooling mat') measuring approximately 50 cm x 40 cm x 1 cm or 90 cm x 50 cm x 1 cm, consisting of: a soft plate of cellular plastic foam of polyurethane impregnated with a gel consisting of water and 1,6% by weight of carboxymethylcellulose. The cooling mat is covered with a waterproof textile fabric of synthetic fibres (polyester), and is coated with plastics on the inside. The cooling mat has a cooling effect on e.g. an animal lying down on it, due to the gel. The cooling mat is put up for retail sale and presented to be used for dogs or cats but can also be used by humans. (See image) (*) |

3926 90 97 |

Classification is determined by general rules 1, 3(b) and 6 for the interpretation of the Combined Nomenclature, and by the wording of CN codes 3926, 3926 90 and 3926 90 97. Classification under heading 9404 as articles of bedding and similar furnishing is excluded, because the cooling mat is mainly intended to provide a cooling effect. Thus, its function is not comparable to that of articles of bedding and similar furnishing of heading 9404. The cooling mat is a composite article within the meaning of general rule 3(b) for the interpretation of the Combined Nomenclature, consisting of a cover of textile fabric, a plate of cellular plastic foam and gel containing carboxymethylcellulose. The gel gives the product its essential character; the plate of cellular plastic foam only has a carrier function, while the waterproof textile merely serves as a cover (see also the Harmonised System Explanatory Notes to heading 3926, point (9)). The mat containing the gel is an article of materials of heading 3912. The cooling mat is therefore to be classified under CN code 3926 90 97 as other article of other materials of headings 3901 to 3914. |

(*) The image is purely for information. |

||